Why Interest rates Differ So much from the Financing Type

Playing cards typically hold the best rates of interest because it try personal loans-i.age., maybe not safeguarded because of the actual physical property. No matter if defaulting with the a credit card loan have a tendency to ruin an individual’s credit, there is no guarantee and that’s captured when the payments is actually not provided. For this reason, highest historical delinquency and you can charges-of cost make mastercard funds more costly to possess loan providers, as they offset those people costs owing to large interest levels died so you’re able to people. This type of situations, and the small-identity and you may variable characteristics from rotating mastercard finance, drive it interest differential than the lengthened-name financial and you will automotive loans, that feature repaired money and are usually shielded from the tangible possessions.

While both this new vehicles and you can mortgages can also loans Pell City AL be cover individuals destroyed repayments and you may starting default, the fresh new repossession or foreclosure of the financing guarantee assists mitigate the fresh new associated losings.

An alternate component that has a tendency to remain covered loan interest rates lower comes to securitization, and therefore involves lenders packing and you will selling packages off automobile and you will mortgage money so you can investors. This securitization from funds transfers the chance accountability of lenders to institutional and sometimes individual buyers. Credit card receivables (a fantastic balances stored by account holders) are possibly securitized because of the issuers but basically to a significantly lesser the total amount compared to the mortgage and you can the auto loans.

A unique foundation decreasing the risk and cost away from mortgages try the latest influence out of federally recognized mortgage loans provided through the authorities-paid people off Federal national mortgage association and you will Freddie Mac computer. None business starts mortgage loans truly, however, both get and you will verify mortgages off originating loan providers throughout the additional home loan market to render the means to access qualifying reasonable- and you may medium-income People in america to advertise homeownership.

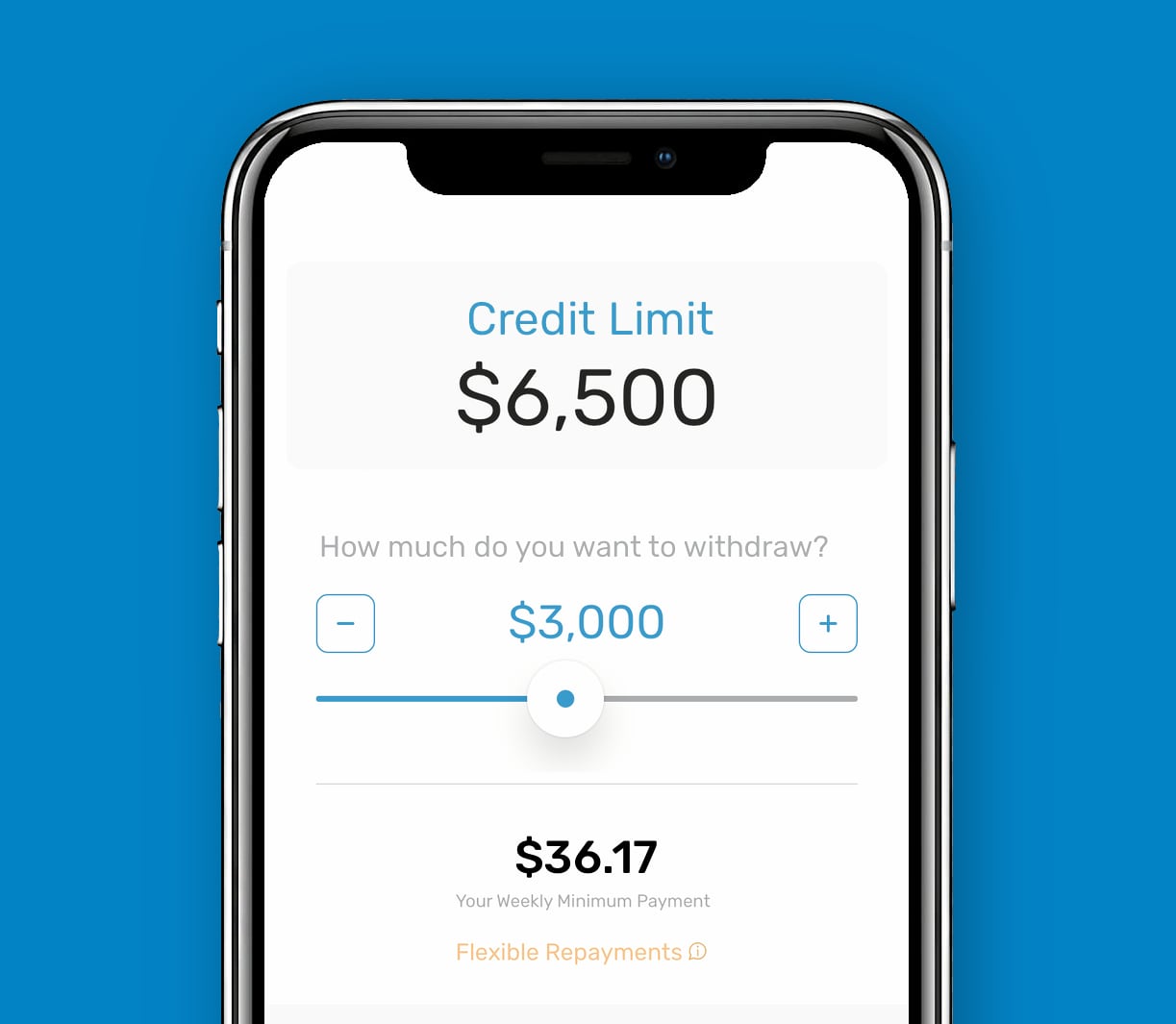

Individuals who sustain extremely in the large-costs sort of borrowing from the bank build merely minimal repayments towards handmade cards otherwise try not to spend its stability in full. These types of debtors are able to find by themselves inside the never ever-ending highest-attention personal credit card debt schedules-especially if they have to make monthly premiums into the most other obligations debt (even after its lower interest rates) just like their home loan or car loan.

Just what character really does brand new Federal Set-aside enjoy?

The new Government Set aside does not put your own rates of interest actually however, do set the brand new government fund speed. Generally, when the government financing speed is actually reasonable, rates of interest with the mortgages or other fund are lower, of course often the interest rate try large or even the sector needs that the Given commonly increase the cost, rates of interest climb. In the , the newest Fed elevated rates on the highest height due to the fact 2001, and they usually have remained at that peak for a lot of conferences since then.

Do my credit history perception my interest rate?

Yes, your credit rating is an important part of your own borrower character, and therefore figures your creditworthiness. The greater your own rating, the reduced their rate of interest just like the bank feedback your while the less likely to default. The lower your own get, the more likely youre to pay high interest levels, and low scores might require that search for a loan provider one focuses on large-exposure borrowers.

When rates of interest go up, their payment increases and the complete amount to lay in order to dominant decreases, given that you’re going to be purchasing a lot more during the attention. You will find how which plays call at your specific disease by using the home loan calculator or the car loan calculator. Because pricing increase, your own payment per month becomes reduced sensible and also you sooner elizabeth household that you might have if rates of interest was indeed straight down.

The bottom line

When you are interest levels to your mortgage loans and automotive loans try climbing, he or she is however typically lower with regards to studies regarding the history 51 many years. Credit card rates of interest has stayed drastically large through the years cousin with other loan brands, mostly due to the unsecured and you will transactional character of these particular from rotating loan device.

72-times the fresh new car loan rates of interest was in fact lower than six% from 2015 (if the Federal Set-aside began recording it) using Q3 2022, into large height at the 5.63% in the Q4 2018. The lowest price at that moment is actually 4.08% for two successive house for the 2016. But once once again, rates enjoys risen since then: Since Q2 2024, the common 72-few days the fresh car loan interest rate is actually up to 8.32%.

Останні коментарі