Bringing a great Va Financing Having fun with Solution Tradelines

Tim is actually financing maker on Veterans Joined Lenders (NMLS #373984) and you will a former borrowing from the bank associate. The guy assists Pros and service people browse the field of borrowing and you will one economic obstacles when it comes to their home mortgage needs.

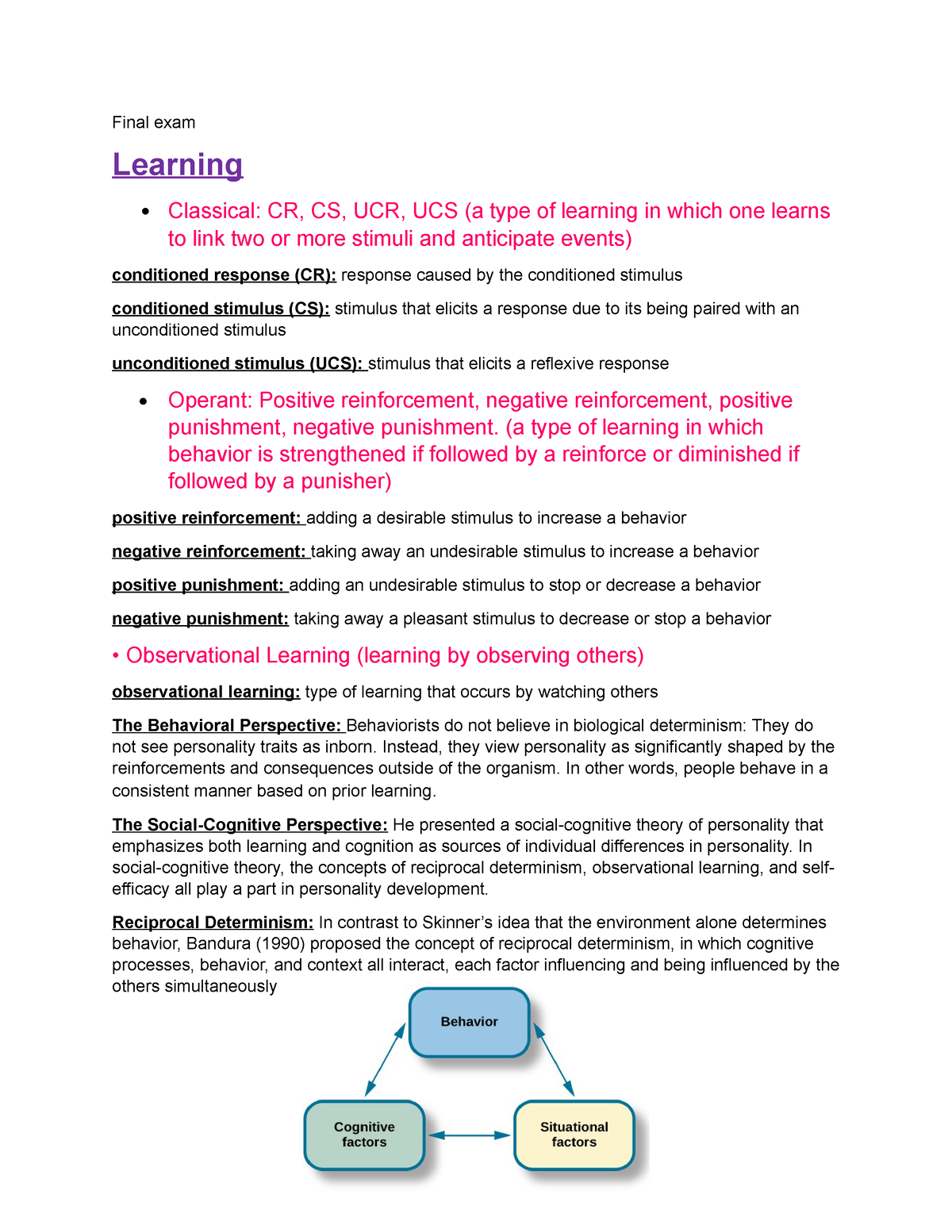

Not all first-go out homebuyers will get a strong credit score, and as uncommon because audio, things such as your cable services bill otherwise P.O. Container can help you property an effective Virtual assistant mortgage. Using solution tradelines can get encourage mortgage lenders that you’re a safe choice.

Standards may differ, however, Virtual assistant lenders are often trying to find consumers with credit ratings with a minimum of 620. Loan providers may also have standards connected with non-tradelines on your own credit report, which can be basically just different kinds of credit accounts. Believe playing cards, automotive loans, student loans and much more.

Look at your $0 Down Eligibility Today!

- Website Map

- Privacy & Security

#step one Va Financial: Experts Joined Home loans given even more Va Lenders because of the regularity than any almost every other bank since . Most readily useful Virtual assistant Get Bank for every Financial Seasons between 2016-2023. Source: Company out of Veterans Activities Lender Analytics

An excellent Va accepted lender; Perhaps not recommended otherwise sponsored because of the Dept. away from Veterans Activities or people regulators institution. Registered in most fifty says. Customers which have questions regarding the loan officials as well as their licensing will get look at the All over the country Mortgage Certification Program & Index for more information.

*Veterans Joined Lenders and you will Veterans Joined Realty promote “Purchase, Offer and you can Save yourself,” a bundled solution system to have Experts United Users. Eligible Customers will get a loan provider credit comparable to you to-hundred (100) base circumstances of your own loan amount, which are often placed on both speed otherwise closing costs or a combination of the two. Depending on market criteria, a hundred (100) base issues try estimate to a single-half (.5) out of a portion part. Instance, just in case max market requirements, a qualified Consumer carry out find its Financing rates down out-of six% so you can 5.5%.

Qualified People must satisfy the following the criteria become qualified to receive the deal: a) checklist a property on the market which have a realtor because of Experts Joined Realty’s advice circle, which have number to occur no later on than 90 (90) days following closing of your acquisition of the brand new domestic, b) buy property having a real estate agent because of Experts Joined Realty’s suggestion community, and you can c) see thirty (30)-season repaired rate capital for the domestic pick that have Experts Joined Home loans.

Exclusive list agreement have to be given and should were an expiration date one runs past the closure go out out of family get, and you will and this affirmatively claims an email list go out off no after than ninety (90) months after the closing of your purchase of the latest household.

All the a house agencies agreements must be on term out of the client and you can/otherwise co-borrower. If your household list business closes just before acquisition of an effective Dodgingtown loans brand new home, the customer could possibly get elect to impede the usage of the deal to the acquisition of a property later on, subject to your house pick closing inside 12 (12) days on the closing time of the property list business (which have any benefit are forfeited if the pick closure will not are present contained in this like twelve (12)-times period). In the absence of an enthusiastic election because of the Customer, the usage the offer could be delayed pending, and you can susceptible to, a fast buy closure, or no, once the explained significantly more than.

It give is not appropriate to help you USDA financing, next lien funds, deposit guidelines, otherwise Bond Applications. Cannot be alongside other now offers.

Providing an excellent Virtual assistant Mortgage Playing with Choice Tradelines

** Average deals example is dependant on 680+ credit score, example eight.5% Rate of interest, and you may $3 hundred,000 amount borrowed; actual month-to-month discounts are different according to the User’s finances.

Experts United Home loans, An effective Va approved lender; Maybe not recommended otherwise backed by Dept. regarding Experts Things or people bodies institution. Signed up in all 50 states . Customers which have questions about our very own mortgage officials and their licensing can get go to the Nationwide Financial Certification Program & Directory to find out more. 1400 Forum Blvd. Ste. 18 , Columbia , MO 65203

Experts Joined Realty step 1-800-985-5723 | 1400 Forum Blvd, Collection 19A, Columbia, MO 65203 Maybe not connected to one government service like the Virtual assistant. Missouri Licensed Real estate Brokerage; having licenses recommendations, check out veteransunitedrealty

This web site uses technologies such as for instance snacks and you will pixels to improve web site possibilities, as well as analytics and you will ads. By persisted, your commit to all of our entry to snacks and you will pixels. Learn more about all of our accessibility snacks and you may pixels in our privacy policy.

Останні коментарі