What is actually an enthusiastic FHA Title step one Do-it-yourself Mortgage?

Perhaps you like your home but desire to you’d an additional bathroom. Otherwise, you’ve got an impairment and want to reduce your cooking area shelves to ensure they are significantly more available. Regardless, taking out a keen FHA Name step 1 Home improvement Loan should be a sensible option-it may not work for visitors.

Term step one Finance was loans provided by banks, however they are guaranteed by U.S. Institution off Housing and you can Urban Advancement (HUD). They are always buy improvements regarding domestic, non-home-based, and you may commercial attributes. Since they’re supported by HUD, they often give low interest and you can good repayment conditions, and then make their renovation investment inexpensive.

Whenever any time you make use of this types of loan?

A name step 1 Financing are going to be recommended for many who should make house solutions but you are struggling to secure an effective household guarantee credit line (HELOC) since the guarantee in your home is restricted,

Exactly how much you could use and exactly how a lot of time you have to repay it is dependant on the kind of family you have got:

- Solitary home: You could potentially use around $twenty five,000 and then have an installment identity so long as 20 years.

- Manufactured/mobile home: You might acquire doing $seven,five-hundred as well as have up to several ages to settle they.

- Multifamily assets: For individuals who own a building you to properties several families, you can use doing $60,000 and also have an installment term for as long as two decades.

As opposed to family equity money, which happen to be secured loans, Term step 1 funds do not require any style of security whenever you are borrowing $7,five hundred or less; when you find yourself borrowing from the bank more than one to, the loan must be protected by the a noted lien towards possessions.

The procedure to take out a name 1 mortgage is commonly shorter than simply a house security mortgage. While the financial studies your loan software, you’ll receive a reply in a few days.

Are you eligible?

When you’re there aren’t any earnings otherwise credit score conditions, you ought to meet the adopting the requirements so you’re able to qualify for a subject step 1 loan:

- You should be the owner of the house or property, or perhaps local rental the house or property (the rent must offer no less than six months outside the loan’s last installment date)

- You must have started surviving in the property for around ninety days

- The debt-to-money proportion need to be 45% or less

- You need to work on a name 1-accepted bank

What you could utilize the money to have

- Use of improvements: If you have a disability, you need to use the loan to switch the house’s usage of. Such, you might decrease your cabinets, expand doors to suit a beneficial wheelchair, or personal loans WI build ramps.

- Livability enhancements: You should use the loan to cover anything that makes your house a lot more livable or of good use. You can also use them for dish washers, refrigerators, or ovens, when they are produced in the house and are generally perhaps not free-position.

You can make use of the mortgage to fund product whether your doing new labor oneself, you can also make use of it to hire a specialist. However, the mortgage can’t be accustomed pay money for luxury updates, particularly installing a swimming pool or a fireplace.

After you submit an application for the mortgage, you’ll have to fill out sometimes an idea with the works you want to perform or your own contractor’s proposition one which just feel recognized.

Different ways to finance household fixes

If you find yourself FHA Identity 1 Do it yourself Money will be a helpful capital choice, they are not the best choice to you personally. You may be restricted in how much money you could acquire, and if you’re planning on taking right out $7,five-hundred or higher, the borrowed funds was secured by the household.

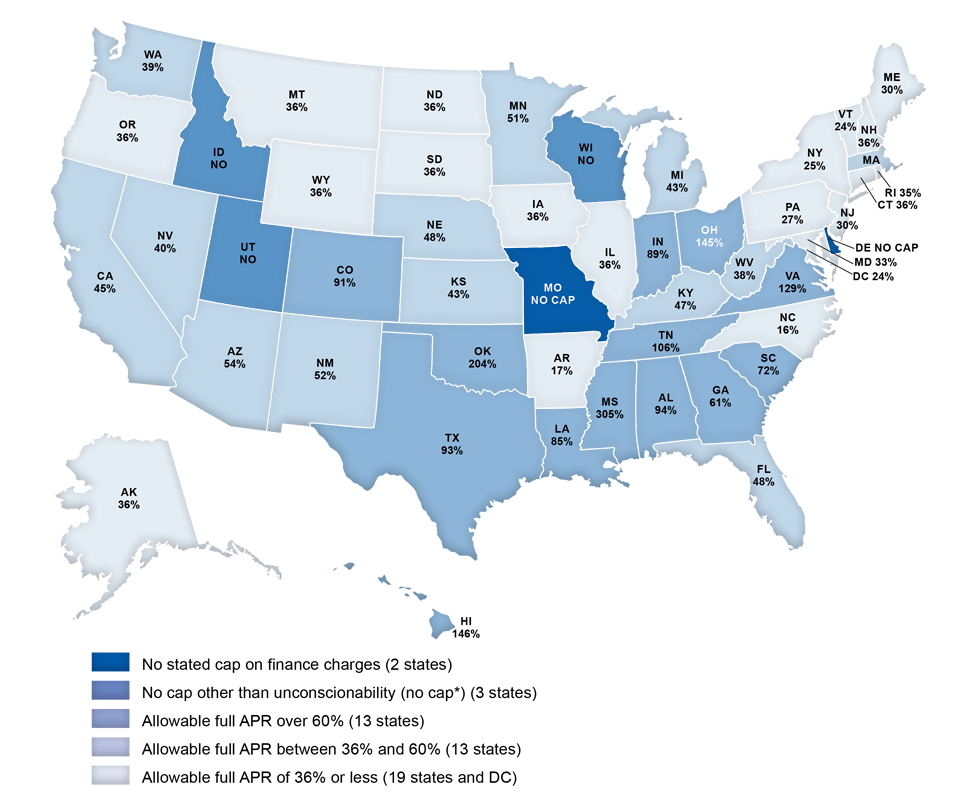

An alternative choice to think was taking out fully a personal bank loan. Very unsecured loans enjoys high limitations, letting you use around $50,000. And perhaps they are unsecured, and that means you don’t have to build your property once the equity. If you have a good credit score, you can qualify for a loan which have low interest and you may has actually up to seven age to repay they and employ new currency you look for match, rather than restrictions on what household home improvements you can certainly do.

If you were to think a personal loan is right for you, here are some Residents Bank. They give fund that have competitive cost and you will an instant recognition techniques. Also, you can buy a rate quotation within a couple minutes.

Останні коментарі