Said Earnings Finance: No Proof of Income? Dont worry about it!

No Earnings Verification Financial of NonQMHomeLoans

The procedure of to get a house may be an extremely exciting sense, nevertheless normally a demanding one to. Probably the most source of be concerned for most homebuyers and of several purchasers regarding money features ‘s the need obtain a beneficial mortgage. Qualifying to possess a mortgage gifts a lot of challenges and waits or difficulties on the being qualified procedure helps it be tough otherwise impractical to complete a profitable bid into property otherwise score to help you closing.

The standard means of qualifying having home financing try time-ingesting, needs detailed files, and that’s not better-suitable for many individuals as well as people that are thinking-employed or with abnormal income.

Or even earn an everyday income out-of an employer having working good nine-to-5 employment or if you try not to prove your continuously discover manager paychecks of many antique mortgage brokers does not even consider your software for that loan even with excellent borrowing from the bank and with large profit the financial institution to own an advance payment for the possessions.

Luckily for us, discover alternatives of having a traditional financial from the local financial, so there was loan providers that are ready and ready to match your role.

NonQMHomeLoans also provide certified customers towards the capital that they you want while making the dreams of property possession become a reality. This is exactly real regardless of the cost of the property you are making an effort to pick, given the home are reasonable considering your debts.

Simplified Mentioned Earnings Money

Insufficient, otherwise incorrect, files could remain individuals from effectively trying to get a vintage financial. We’re opening the way to another family for most just who slip additional antique streams when you’re nevertheless verifying earnings.

To find out if a stated income mortgage ‘s the proper source of resource for your version of domestic buy otherwise investment property get, reach out to NonQMHomeLoans today to possess help.

What is actually a reported Money Mortgage?

A reported money mortgage try a mortgage loan you could get as opposed to providing the proof money that is normally called for so you’re able to safer home loan funding. With several antique banking companies and you may mortgage brokers, you need to offer thorough paperwork of all the of one’s resources of money. You might payday loans Sandy Hook have to complete numerous years of taxation statements out-of this new Irs, along with shell out stubs, lender comments showing paycheck places out of companies, and other proof of money. The financial institution will most likely would also like to ensure your own a position of the talking-to brand new workplace to confirm that you are nevertheless operating towards the team during your property purchase.

A reported income financing exists without any financial acquiring a separate verification of the earnings away from tax returns otherwise similar present. You will simply county your earnings and steer clear of all myriad conditions normally set up to possess guaranteeing extent you get from a manager.

Which Need to have a stated Income Financial?

One to quite common reason why homebuyers and you may property people see stated earnings finance is they possess unusual sources of money.

Such types of money will most likely not satisfy conditions imposed by traditional banking companies or it ple, your money you are going to come from family unit members benefits otherwise from a business that you own.

Otherwise, you really have frequently changed work so you may not able to offer numerous several years of pay stubs and you may verification out-of a certain boss that you were earnestly performing.

For individuals who routinely perform work with overseas people, in lieu of to possess organizations in the united states, you are able to not have the fresh new evidence of money that traditional mortgage lenders need so you can approve you for a loan. The business you struggled to obtain can also no longer getting functional, so taking a career verification would be difficult otherwise impossible. Or, you can even simply be mind-employed and now have no company you work with to ensure their income.

Many people are concerned about remaining the information safer, particularly in this era whenever even huge organizations are prone to hacking otherwise had been trapped misusing personal customer advice. By giving intricate income tax forms in order to lenders, you will be making on your own prone to the your very delicate recommendations losing towards the wrong give.

There may also be a special effortless reason you want to get a stated earnings mortgage instead of a traditional home loan:

You will possibly not want to spend days if not months event the required records to add proof your earnings.

Making an application for a mortgage are going to be an excellent bureaucratic horror of documentation, distribution mode demands, and you will delivering files. Going through the strategy to receive proof money and you will a career can get simply not getting really worth the energy.

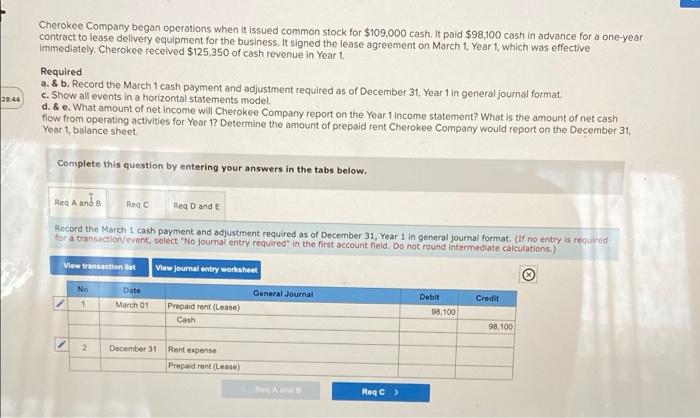

Qualifying to own a stated Income Mortgage

When you’re a reported money loan does not require that you promote proof of earnings, you nonetheless still need to meet up with specific first being qualified criteria under control to get financing. NonQMHomeLoans helps to make the techniques as simple and you may straight forward you could. Some of the items that we offer from inside the financing recognition processes were:

- Choosing simply how much you can afford to obtain: The said earnings, assets, a career history, and you will debt-to-money ratio will all assist to influence what kind of cash you could potentially get.

- Getting pre-qualified for a loan: You will need to offer some basic facts about your a career, household history, and you can property you own. Additionally, you will need certainly to offer permission to own NonQMHomeLoans discover a backup of one’s credit history as reviewed. Once your suggestions could have been analyzed, we can promote good pre-certification letter that may leave you insight into how much you could acquire and that will make it easier to as you store getting and place estimates to the a property.

- Trying to get the loan: So it takes place with the aid of one of the home loan masters after you have set a deal into the property and you may got that offer recognized. Our very own mortgage advantages commonly guide you using each step of application procedure which will be simple and sleek because you manage not have to provide proof financial earnings.

- Closing and you will investment the mortgage: After recognition, NonQMHomeLoans coordinates to your term business or escrow organization which is addressing the closing in order that the procedure happens smoothly therefore the cash is marketed regularly which means you can acquire your residence.

Many people can be qualify for a stated income financing more quickly and simply than they might be able to see financing out of a bank or a cards relationship that really needs full documentation to own money. Which have let form all of our loan experts, there are best brand of said income financing one you might qualify for and certainly will allows you to pick the house you have always wanted.

Останні коментарі