Difference in discover and you will finalized bridging loans

You can end leasing property on the interim. Renting requires much time and energy, not to mention the extra can cost you. By using out a primary-title bridging mortgage, you don’t have to maneuver around multiple times.

You can streamline loan payments. Specific loan providers allow you to create costs in your current financing immediately after which start connecting loan payments after you have ended up selling the dated domestic. This means you are not balancing numerous loan money simultaneously.

You might use a lot more will cost you into the bridging financing. This is going to make buying the new domestic even more easier. You could add stamp obligations, courtroom charges, and other can cost you in your home get regarding the bridging loan given you’ve got the credit capabilities offered.

Downsides off a connecting loan

You may have to offer your home at a lower price. By rigorous timeline having connecting finance, you may need to get-off a fortune to the table in order to promote the home quickly till the connecting mortgage label stops.

You’ll have to has a couple of possessions valuations. That for your newest assets and something to the possessions your decide to pick. Even more valuation costs you will definitely easily sound right and leave your that have significantly more costs.

You may have to pay high interest rates. For the connecting funds several months, you will probably become charged a top interest compared to the a good fundamental home loan. If in case you never sell your home inside financing label, could cause using also huge interest levels.

You may have to pay cancellation costs. If you find yourself altering loan providers to locate a connecting mortgage, you will have to pay early hop out costs on the most recent home loan.

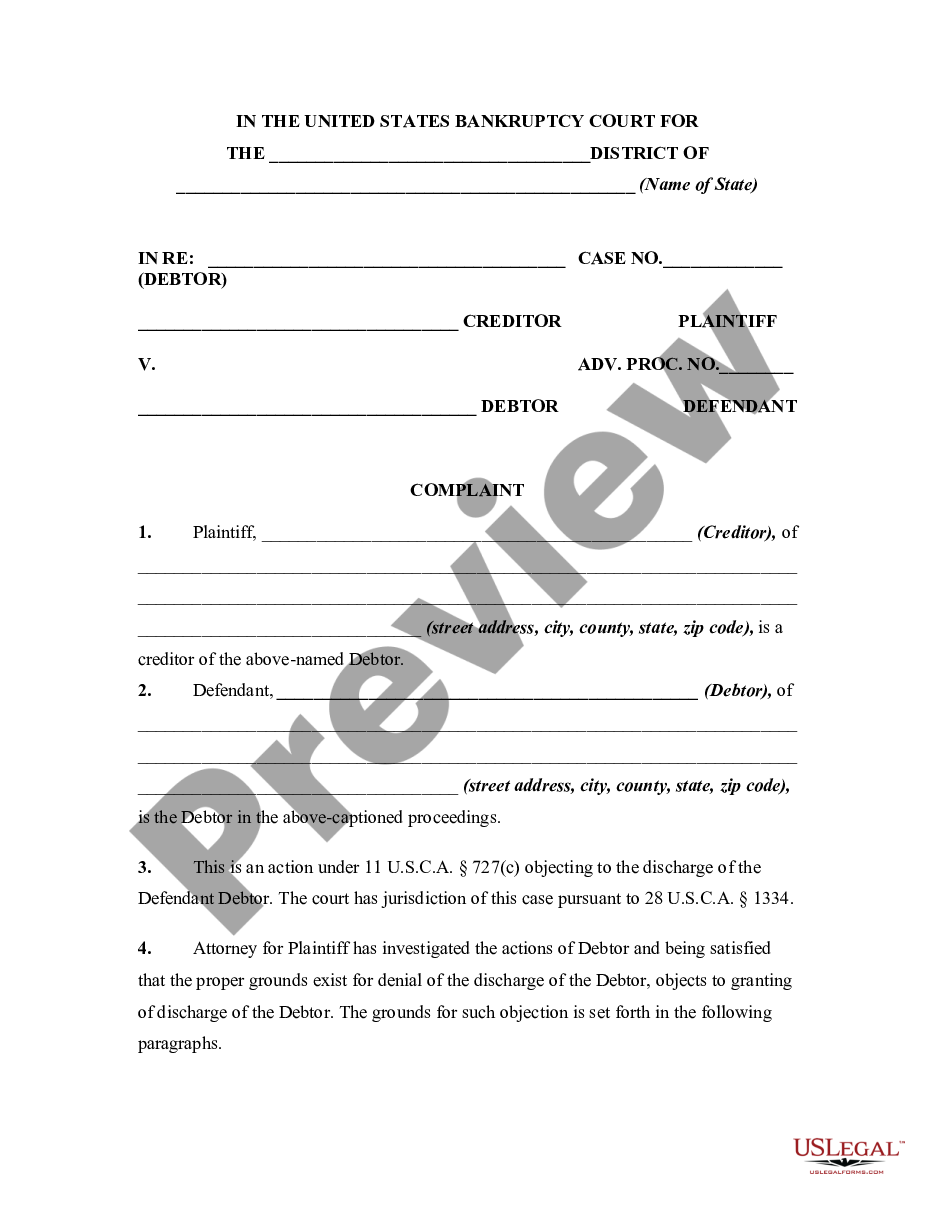

There are two main brand of connecting funds you could select from. Though both promote quick-identity property loans, brand new criteria for these fund will vary. Some lenders and just render one kind of bridging loan.

Discover connecting funds

An unbarred bridging mortgage is used once you haven’t marketed their newest possessions yet ,. You could potentially take-out an open bridging mortgage if you’ve receive property we want to purchase but still have your dated domestic in the market. This really is a discover-finished loan.

Finalized connecting finance

A shut bridging loan is for anyone who has an agreement off Selling on the dated household. This is exactly for those who are undergoing moving the home and discover if it might be offered. Because of it sort of bridging loan, consumers pays the loan and the accumulated notice charge toward brand new go out its dated residence is offered.

How do you qualify for a bridging mortgage?

Connecting financing eligibility varies from lender to personal loans in Idaho help you lender. Loan providers usually normally go through the pursuing the before approving the bridging application for the loan:

Home guarantee – the greater guarantee you’ve got on your old family, the newest shorter you must borrow on the financial. Particular lenders want the very least security out-of 20% to apply for a connecting mortgage.

Avoid debt – loan providers are going to check how much stop debt you may be browsing has actually. You’ll find loan providers online which offer connecting financing as long since the you will find a conclusion financial obligation that could never be your situation whenever downsizing.

Profit bargain – for those who opt for a closed connecting loan, loan providers could possibly get inquire about proof sale or a copy out-of the new business deal for your present property.

Want a minimal price connecting loan? Contact

Discover more about bridging money and how they are able to assistance to the circulate! Get in touch with a friendly financing specialist today and you can allow them to help you reach finally your a property goals.

You can purchase your house you need instantly. You don’t need to hold back until the newest sale of the current home to begin with swinging qualities.

Останні коментарі