One way to retrieve Teaspoon money when you’re working is by using Tsp funds

The newest Thrift Savings Plan (TSP) is actually a critical element of a successful later years purpose to possess FERS retired people. Learning how to access your own Teaspoon for the old-age is vital, you have an approach to obtain their finance while you are doing work.

Before taking a tsp financing, an entire feeling from withdrawing old-age finance early should be considered, because you will need certainly to pay-off the borrowed funds having appeal. Extenuating circumstances can bring about the requirement on the best way to drop into Teaspoon just before getting later years.

The statutes discussed below are standard Tsp financing legislation. The fresh new CARES Act off 2020 made certain alter to help you accessing their Teaspoon for it seasons. Select the CARES Operate website getting realities.

Type of Financing

The fresh new Teaspoon also offers 2 kinds of financing: residential and general purpose. Because the title indicates, new domestic mortgage can only be obtained on get or build of a primary quarters. A residential loan can not be familiar with refinance a preexisting financial and merely and come up with repairs so you’re able to an existing household. A residential financing provides an installment period of you to fifteen years and you will files becomes necessary.

The following kind of Teaspoon loan try a general purpose financing and that is drawn for any explore. In contrast to new domestic mortgage, a broad purpose financing doesn’t need files features good repayment ages of that five years.

It should be indexed your minuscule amount borrowed you might obtain are $1,000 and you will only have that general-purpose mortgage and you can that home-based mortgage a great at the same time.

That will Apply?

- Enjoys no less than $step 1,000 of one’s benefits on the membership.

- Must be currently operating due to the fact a national civil employee or associate of your own uniformed qualities

- Have not paid down a teaspoon loan (of the same kind of) entirely within the last 60 days

- Have not had a taxable shipment on the financing from inside the earlier 12 months, unless of course the latest taxable withdrawals resulted from the break up regarding federal provider

Just how to Apply

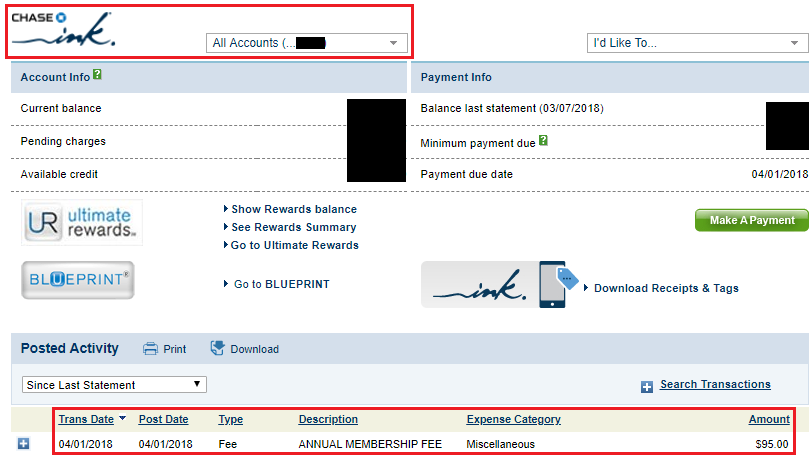

Whenever applying for a standard objective loan, you should be capable finish the process entirely on line, except if your situation suits one of the after the problems. While you are requesting currency by way of an electronic digital fund import otherwise youre a wedded FERS or uniformed characteristics participant and carry out n’t have a medication Function Teaspoon-16 towards file, then you’ll definitely have to print-out and you will submit the borrowed funds agreement having operating. Whether or not finishing the application on line or by print it, step one will be to get on your bank account and you can start the method. You’ll be able to complete Mode Teaspoon-20 and mail otherwise facsimile it to Teaspoon when you do not want to fill out your data via the website.

The method to have requesting a americash loans Trussville domestic financing can be a bit different while the specific records required. Comprehend the Fund publication for much more about it processes.

Finally, it is essential to be aware that a tsp mortgage has no effect on taxation except if it is not paid down prior to retirement. Otherwise paid off, a teaspoon loan may be addressed given that a taxable distribution and you may determine the taxation.

Discover The options

Because the a federal staff member, you’ve got a wide level of solutions. The new choices you will be making when you’re functioning-instance whether or not to capture a tsp financing-often impact your retirement. It is important to know about what your options are and you can the possibility consequences of tips.

Disclosure: All the information within these types of posts really should not be utilized in one actual exchange without any pointers and you can recommendations away from a tax otherwise financial elite group who is used to most of the associated items. The information contained here’s general in the wild which is maybe not suggested due to the fact court, income tax otherwise capital pointers. Furthermore, what contained here may not be applicable in order to otherwise suitable on the individuals’ particular issues or requires and could wanted attention regarding other issues. RBI is not a broker-agent, financing advisory firm, insurance company, or service and does not bring capital or insurance rates-associated information or information. Brandon Christy, President from RBI, is also chairman away from Christy Financial support Management, Inc. (CCM), an authorized resource advisor.

Останні коментарі