Just what records manage I would like getting a protected loan?

A protected financing, called a good 2nd charges mortgage’ is a type of finance which enables you to help you borrow cash against property you individual.

The many benefits of using your property as the shelter imply that particular lenders will be able to give a much bigger financing which have greatest interest rates, or provide you with fund even though you reduce than simply prime borrowing.

How do secured personal loans works?

When taking away a protected financing, your use a lump sum of money against your house and you will pay it back from inside the monthly instalments (in addition to interest) more a consented long time.

We like while making the application since simple as you’ll be able to. Perhaps not everyone’s activities will be the exact same thereby we do not require an identical files out of group. Particular fundamental data we require try:

- Earnings advice (Payslips, Taxation statements, etc)

- Business Construction function (in the event the applying into the a friends title)

The length of time can it decide to try get a guaranteed loan?

It requires approximately step three-a month to obtain a secured loan, yet not a lot of points may cause the procedure to take quite stretched.

Willing to chat?

People assets put because the cover, as well as your household, are repossessed if you don’t maintain repayments towards the your loan or other personal debt protected in it.

- Access to

- Jobs

- Webpages terms of use

- Privacy and cookie policy

- Carry out Cookies

- Providers formula

- Progressive Slavery Act Statement

To each other are a trading particular each one of the undernoted businesses, that have their inserted workplace address at Lake See, Lakeside, Cheadle, Cheshire SK8 3GW.

Together Financial Characteristics Restricted | Entered from inside the England and you can Wales – Organization Registration Count 02939389. Together Economic Qualities Minimal is the agent regarding the site.

To one another Individual Money Limited are authorised and you may regulated of the Monetary Carry out Expert (FCA). FCA matter is actually 305253. | Inserted within the England and Wales – Company Registration Number 02613335. To each other Private Finance Limited is actually a member of new FLA. This new FLA Financing Code is present within .

Blemain Funds Restricted is authorised and regulated of the Monetary Make Authority. FCA count is actually 719121. | Inserted in the The united kingdomt and Wales – Company Subscription Matter 01185052.

What is actually a guaranteed mortgage?

A secured financing, known as the second costs otherwise another financial, is a type of mortgage that allows people in order to borrow cash up against the security inside their possessions.

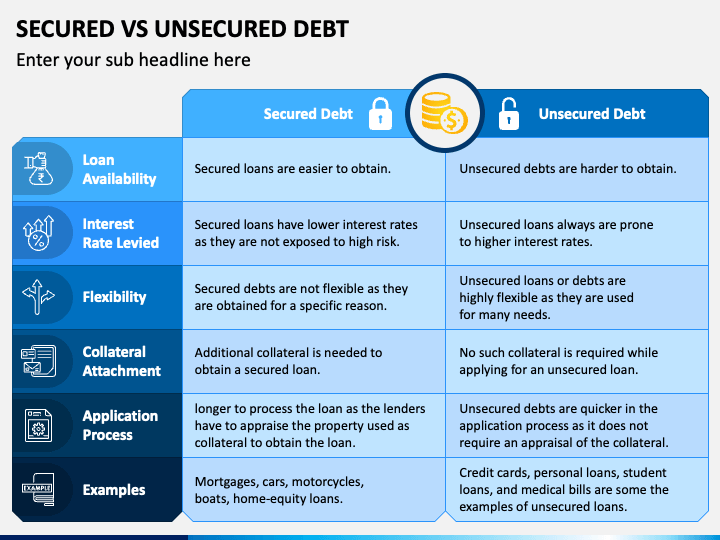

The interest rate from a protected loan might possibly be somewhat higher than just an everyday home loan considering the greater risk with it of the the lending company. Yet not, the pace with the a protected mortgage often is cheaper than an enthusiastic unsecured normal unsecured loan.

The initial fees of the home was kept by the top mortgage company. If there is repossession, the original costs home loan will be paid basic in the proceeds with any secure financing otherwise subsequent fees.

Secured loans for various intentions

Renovations A protected financing can be used to funds renovations including as another type of kitchen, restroom, or extensions etcetera. This type of improvements may end in an increase in property value through the years.

Debt consolidating Both unsecured debts particularly handmade cards otherwise funds, or other secured finance should be consolidated playing with another secured financing. Great mortgage pointers becomes necessary right here because you will need be manufactured alert and you can explain to you one threats a part of your financial mentor.

Initiating Financing There are many reasons as to why website subscribers manage believe a secured financing to raise investment. Instance permitting nearest and dearest, an enormous get otherwise vacation, home solutions, tax costs etcetera.

Останні коментарі