Having fun with Overtime Earnings In order to Qualify for Mortgages

Having fun with overtime income to meet up with the requirements to have mortgage loans try acceptance lower than certain items. Each other overtime income and you will solution money provide was deemed appropriate to have anybody applying for home financing.

But not, to get eligible, the new debtor need showcase a regular a few-12 months reputation for receiving overtime earnings. Moreover, there must be a fair assumption the overtime earnings and you may most other supplementary sources will persist for another 3 years. It is important to highlight one to fulfilling the high quality dependence on a good ft income stays a necessity.

This web site focuses primarily on playing with overtime earnings in order to be eligible for mortgage financing and also the important matters you have got to consider when using overtime and you can second money to acquire home financing.

Having fun with Overtime Earnings or any other Variety of Abnormal Low-Conventional Income In order to Be eligible for Mortgage

Understanding the need for certain earnings avenues is crucial whenever navigating the complexities regarding mortgage qualification. Within perspective, playing with overtime money, income out-of part-time works, and bonuses is actually good sources of more money.

Mortgage underwriters firmly high light researching the stability of these earnings, aiming to guarantee their continuity along side second 3 years. This careful review are inbuilt towards the mortgage acceptance processes, since it provides lenders with certainty regarding borrower’s financial skill meet up with financial financial obligation.

Home based loan degree, potential individuals need know the necessity of openness and documents off overtime income and you may second income. Presenting a history of consistent a lot more income more than a lengthy several months is bolster one’s app. More over, this blog is designed to delve into just how lenders understand and assess overtime earnings, offering worthwhile wisdom to people trying influence such as for instance money having their residence mortgage qualification journey.

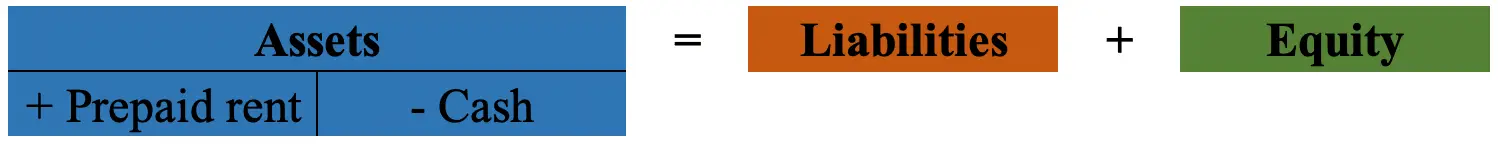

Using Overtime Income To help you Number To the Qualified Verified Income

Loan providers try and make sure some body trying to mortgages feel the financial power to meet their upcoming property percentage financial obligation. An important basis encouraging lenders’ believe https://paydayloansconnecticut.com/old-mystic/ is sufficient qualified income, which pledges a flaccid and you may timely repayment of your forecast property expenses. It is important to remember that licensed money ‘s the personal type of money recognized for eligibility for the obtaining mortgage brokers, and money income will not meet the requirements within this framework.

When you look at the securing a home loan, loan providers prioritize to be certain borrowers contain the expected financial method for see the construction commission responsibilities. This new crucial ability instilling count on in the lenders was good-sized certified money, making sure the fresh smooth and you may quick payment of upcoming casing-related expenditures. You will need to highlight you to definitely accredited money is the merely acknowledged form of earnings noticed to have qualification on approval techniques to possess lenders, with cash money losing away from greeting details. Entitled to Safer Home loans, Click the link

What types of Income Can be used As the Licensed Earnings To own A home loan

Borrowers feel the flexibility to help you power individuals sources of earnings for more degree, having fun with overtime income as one of the secret contributors. In addition to overtime income, part-go out income, bonus money, fee money, royalty earnings, or any other accredited earnings stated to the income tax efficiency are considered qualified.

Although not, to add which additional income on qualification processes, it ought to have shown a frequent history of at the least 24 weeks. Loan providers need which stability just like the a protect, making sure the cash will most likely persist towards the next three ages.

Within the validation procedure, businesses is generally contacted to ensure the fresh applicant’s work status and you can the accuracy of your qualifying earnings.

How do Mortgage lenders Be sure A position

Home financing processor protects the utilization verification techniques into the financial company’s part. Mortgage officials are cautioned up against granting pre-approvals so you’re able to borrowers exactly who believe in option earnings present without the right work confirmation. To facilitate that it, loan providers normally implement a jobs Verification (VOE) means, and this businesses have to precisely over.

Останні коментарі