Credit rating Out of 540: Just what it Way for Fund & Credit cards

Precisely what does a credit rating regarding 540 suggest? Is a credit score of 540 good otherwise bad?

A credit score away from 540 is regarded as Worst. Indeed, people credit history less than 619 can definitely need a cost towards another person’s lives and not inside the an ideal way. The effects are going to be tough than simply you to definitely might think.

On this page, we are going to express just what that have a credit history away from 540 way for home loans, car and truck loans and handmade cards. In addition to, we will show simple tips to increase a beneficial 540 credit history.

Credit rating of 540: Auto loans

To buy a car or truck that have a credit score out-of 540 is possible, however, high rates of interest will always be made available to individuals with crappy borrowing. What’s the rate of interest for a credit rating out of 540 on a car loan?

Basic, let’s use the average loan amount from the car consumers: $twenty-seven,000 according to Melinda Zabritski, Experian’s elderly movie director of motor vehicle borrowing. Today, why don’t we cause of the three preferred particular automobile financing offered in order to united states from inside the myFICO’s loan offers calculator: 36-few days this new car loan, 48-month this new car finance and you will an effective sixty-day new car loan.

Let’s consider simply how much so much more an automible can cost you for an individual with a credit rating out of 540 compared to good credit score from 640.

Is a credit rating away from 540 rating an auto loan? Since the graph above reveals, bringing a car loan which have a good 540 credit rating is going to help you ask you for far more. To your a thirty-six month brand new car loan, you will be charged $2,545 far more. Towards a beneficial forty-eight few days, $3,481 a whole lot more. Towards an effective sixty few days auto loan, it will cost you an astonishing $cuatro,411 a great deal more.

To put it differently, in case your obtained converted to a good 640, you might save thousands of dollars on your loan. Don’t you consider it is really worth a hundred or so cash to exchange your borrowing from the bank prior to taking a road test? Get in touch with Go Clean Credit to begin.

Credit history out of 540: Playing cards

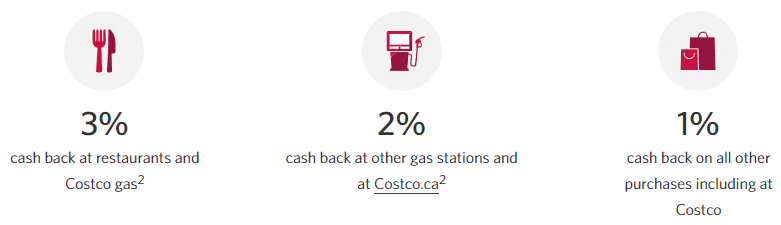

All round guidelines which have playing cards is the fact people rating over 600 will get qualify for an unsecured credit. When you have a credit score off 540, you will only qualify for a guaranteed bank card and you will are expected making the absolute minimum put so you can open the mastercard. Go Brush Credit continually evaluates borrowing choices and you can already suggests this type of Safeguarded Cards for people with a credit score out of 540.

We have seen to an effective 40 area boost in borrowing from the bank get by starting one of these notes. What takes place toward Apr for a credit history off 540? The following is a chart showing the distinctions anywhere between yearly costs and you will attract cost between somebody that have good credit and you can a credit rating of 540.

Credit rating off 540: Lenders

Let’s say youre an initial time home consumer with a great credit score out of 540. Can also be a credit rating of 540 get a property? Is it possible you rent with a credit score off 540?

For the majority mortgage loans just be significantly more than an excellent 620 borrowing score, but you will find several money around that go down to help you 540 for FHA. But then most other variables get more challenging (lifetime loans to help you income) it will make it pretty hard to meet the requirements less than 620.

Can you imagine that you may possibly qualify for good FHA financing with a credit rating of 540, however, once we are able to see on the charts lower than, a decreased FICO score increases the amount of money you will find yourself paying for that loan throughout the span of their lifetime. In case your FICO get try less than a great 560, extremely lenders does not actually envision providing you a beneficial jumbo financing to possess an effective FICO rating one to lowest.

Note: Brand new 30-year repaired jumbo home loan APR’s is estimated according to the following the presumptions. Fico scores anywhere between 620 and 850 (five hundred and you will 619) guess an amount borrowed of $3 hundred,000, step one.0 (0.0) Items, one Nearest and dearest Owner Filled Possessions Type of and you can a keen 80% (60-80%) Loan-To-Worthy of Proportion.

So is a credit rating out of 540 score a mortgage? Perhaps. However, getting a home loan that have a credit rating away from 540 usually create a supplementary $105,480 throughout the borrowed funds than simply some body that have good 721 credit score. The speed to own a credit rating out of 540 increase new monthly homeloan payment by the $183 over someone with a score 95 products high, at the a credit score off 635.

Ideas on how to Improve A credit score from 540

Exactly how crappy was a credit rating out of 540? Since the we’ve got observed in the new areas a lot more than, so it score has an effect on every facet of your financial life. Mortgages, automobile financing and you may mastercard interest levels are considerably high than just they might become if you had average borrowing from the bank.

If you want to evolve your credit score off 540, there are some ways you can go about it.

1) Peruse this blog post about how to Alter your Credit history Within a month. I installment loan Windsor checklist simple tips within this post particularly paying revolving stability so you can lower than 30% or other info which can alter your get quickly.

2) Peruse this blog post on which Not to ever would whenever restoring borrowing from the bank. The worst thing you should do are move in reverse inside your time and effort to switch the borrowing from the bank disease.

3) For those who undoubtedly need replace your credit score inside 31 months, might work for by the hiring the help of a cards repair organization instance Go Clean Credit. For additional information on all of our borrowing resolve applications, please call us.

Long lasting your role, Wade Brush Borrowing from the bank has a simple solution. You will find many borrowing resolve applications that are offered to help your overcome their credit problem and set your straight back towards the path to monetary achievement. Real borrowing maintenance isnt an effective once dimensions fits all of the model therefore tailor your needs on the right system, but the majority anybody can begin for $99 per month.

We have repaired rates software that get you right back focused in as little as 5 months, obligations quality alternatives, apps aimed toward people with had current short transformation or property foreclosure and others. Help is only a no cost call aside or you can fill out a scheduled appointment demand. Get in touch with Go Brush Borrowing from the bank so you’re able to schedule a no cost consultation today.

Останні коментарі