nine Suggestions for To get good Preforeclosure (Particularly if Theys The first)

- Wrote towards the

- 5 minute read

June Rylander was a freelance blogger and you will publisher which have an abundant records in the a property. A former residential real estate agent regarding the Columbia, South carolina urban area and you can conversion process manager within a commercial a home corporation, she now uses so it feel to greatly help guide readers. June already lives in Nuremberg, Germany, where she satisfies their particular interests of food and traveling and you may stops their particular detests of mayonnaise being swept up from inside the a workplace.

Thus you’re considering to shop for a home, and you also start to look around on the internet merely to look for what exactly is on the market. Due to the fact you’re going to get accustomed the new lay of the land – eyeballing homes that seem to get to know the standards and you can fit your budget, daring to let your self feel thinking about the possibilities – perhaps you find an email list noted as the an effective preforeclosure.

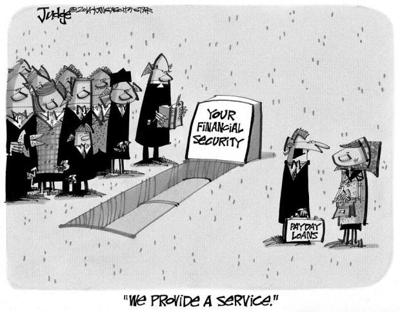

The fresh new pictures reveal a house that appears like it’s in the a good contour, additionally the price is neither suspiciously reasonable nor alarmingly higher. Therefore what payday loans New Union is the package? What does preforeclosure even indicate?

One which just hurry toward (otherwise off) something, let’s reduce and take a look at what you want to learn about to shop for a house inside preforeclosure. With best agent and you can San francisco a residential property professional Rick Heavier, we’re going to safety 9 essential tips for in search of and purchasing a great preforeclosed domestic.

step one. Understand what preforeclosure form

Since label suggests, your house involved was handling foreclosure. The latest resident are at the rear of on home loan repayments, and even though they do still have an opportunity to catch-up until the lender seizes the house or property, a formal see off default could have been granted.

Once the notices from default was public records recorded to your condition, this article is now societal. It generally does not show from the just how many money; it just means that discover an official notice that this citizen, it borrower, is during default, states Thicker.

2. Be aware of the difference between preforeclosure and you will quick sales

At first sight, there may seem to be the thing is that ranging from property into the preforeclosure and a primary purchases property, although a couple of are very different.

The type out of an initial revenue is the fact that homeowner owes over just what house is value. We might together with claim that these are generally under water,’ explains Fuller.

Once they were to promote the home, they will haven’t any continues and you may carry out in fact owe brand new lender and/or lienholder money in the course of closing.

To eliminate so it shortage, small purchases homes include discussing on the mortgage company to offer the home at under what’s owed. Owner can then usually leave on the closure desk instead of owing things after that.

An effective preforeclosure does not mean that vendor does not have any any guarantee; it just means they are going on the a property foreclosure, notes Fuller.

3. Remember that the latest resident provides choices

If you’re selling the property before it gets into foreclosures is an effective prominent services of these during the preforeclosure, it’s still easy for a homeowner to remedy its condition and maintain their house.

Individuals into the default normally mention options for financing modification or a forbearance plan, and that might need discuss with the loan servicer. Since a possible purchaser, it is worthy of being aware one to sometimes land look across the more on the web portals if the notice out-of default is on number, and that doesn’t invariably mean new resident wants to sell.

In a nutshell? End delivering starry-eyed more than an excellent preforeclosure household unless you understand the holder are happy to cam. Be cautious, too, of your peoples regions of financial hardship. A small compassion goes quite a distance an individual was up against the possibility death of their home.

Останні коментарі