Which are the better choices for my personal home loan?

Into the a property, place was what you-especially when you are looking at the mortgage businesses area. On the web companies can vow skyrocket-timely mortgages-however, Red-colored River Bank Financial actually provides. Our very own experienced cluster understands neighborhood layered service and in-urban area decisions, we could flow even faster.

Yellow River Bank even offers great solution, quick closings, and some options for real estate. Pertain On line for all the of those options.

Old-fashioned mortgage loans

Antique financing come with the a predetermined rate towards lives of your mortgage of these which have more powerful borrowing from the bank. Guidelines support a good step 3% down payment for very first-go out homeowners and you can an excellent 5% downpayment for everyone other buyers. There is certainly private financial insurance rates if you place less than 20% down.

FHA is made for situations when downpayment ability and you may borrowing get are reduced-guidance allow doing a 96.5% mortgage so you can worthy of ratio and you can credit ratings as low as 580.

Virtual assistant money are around for all the eligible pros and enable having as much as 100% funding. But not, you can find fees energized from the Va one wouldn’t be provided towards a conventional home loan. If you’re a veteran having 20% down, you may be finest served by a traditional mortgage.

Outlying Advancement

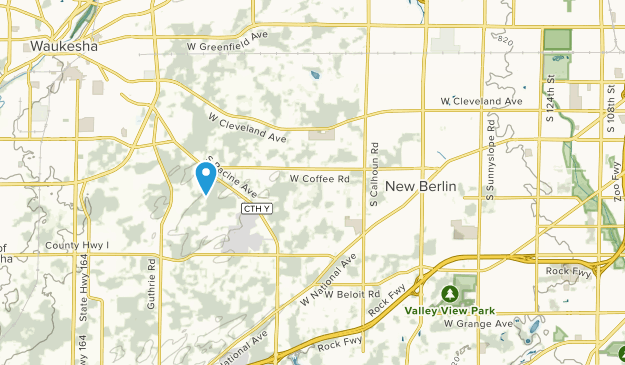

Outlying Innovation Fund try a USDA product built to let reasonable- to reasonable-money family pick a property. For folks who satisfy income, credit or other criteria, you could potentially be eligible for 100% money toward a house outside the urban area restrictions.

Environment for Humankind

Environment having Humanity are happy to do business with Red Lake Financial introducing the fresh Reddish In addition to Loan Program getting Home improvements. Habitat people tends to be entitled to a great $twenty-five,000 Number one Residence mortgage to own home improvements, equipment, or other private requires. And you can, zero closing costs was assessed! Should be newest to the mortgage, possessions fees and you will home owner insurance.

Reddish https://paydayloanalabama.com/decatur/ Mortgage Program

Reddish Lake Bank’s Recognizing Everybody’s Fantasy (RED) Loan System will bring 100% funding and no private financial insurance rates to people to acquire a home inside the a qualifying area otherwise town. Borrowers will get located a $2,five-hundred give and could be eligible for an additional home loan to have around $5,000 to make use of into the mortgage, moving expenses, devices, and other points. There are not any money maximums because of it loan.

Red And additionally Loan System

Red Lake Bank’s Recognizing Every person’s Fantasy (RED) And Loan Program has arrived in order to create your house your property. Homeowners from inside the qualifying areas may be qualified to receive a beneficial $twenty five,000 Primary Household loan to have home improvements, devices, or any other personal requires. And you may, zero settlement costs would-be assessed! There aren’t any money maximums for this loan.

There are a number of applications which help buyers having down commission – and you may our company is mostly of the home loan teams which participate in them. Of numerous include limit earnings constraints, work for basic-time homeowners, and gives guidelines on listing of 3-7%. You will find conditions to the general direction, yet not – and then we look for most of the window of opportunity for Reddish River Lender people.

Individual financial mortgage loans

Getting people whose property, occupation and you will/or real estate need reaches a level that requires tailored selection, our private financial party now offers custom mortgage provider.

Piggyback money

Having people that an excellent borrowing and you will meet with the income conditions, we possibly may be able to do combination money to stop brand new cost of mortgage insurance policies. Learn more.

Parcel money

Parcel capital need will vary widely, and so perform our selection. As an example, we might make that loan in the 100% LTV to own a short period if you are waiting for the structure, otherwise to 85% LTV having a five-year repaired rate getting consumers who require to acquire a lot and build security before starting construction. Learn more.

Останні коментарі