New report mostly comes with your credit history, latest balances, and delinquent expense

You can love to lower your mortgage loan price by buying write off facts. One disregard section is equivalent to step 1% of one’s amount borrowed. One to write off area decrease the 31-season Virtual assistant financing rate by the 0.125%.

Name Insurance rates payment covers the homebuyer as well as the mortgage lender of being stored liable for problems including outstanding mortgages, liens, and you will court judgments missed from the first label search just after property ownership are transferred.

Credit file commission covers the expense of conducting a credit score assessment for you. It commission can differ depending on how far data is expected.

Assessment commission is actually repaid in order to a beneficial Va-recognized appraiser in order to estimate the value of the house, concur that the home is move-during the ready, and you can match the Experts Affairs’ minimal property conditions. That it payment utilizes your location and kind away from property.

Application Process

A beneficial pre-recognition will give you a definite thought of exactly how much household you really can afford. Because of the to present an excellent pre-recognition page, you excel in order to vendors and real estate agents as a good serious buyer.

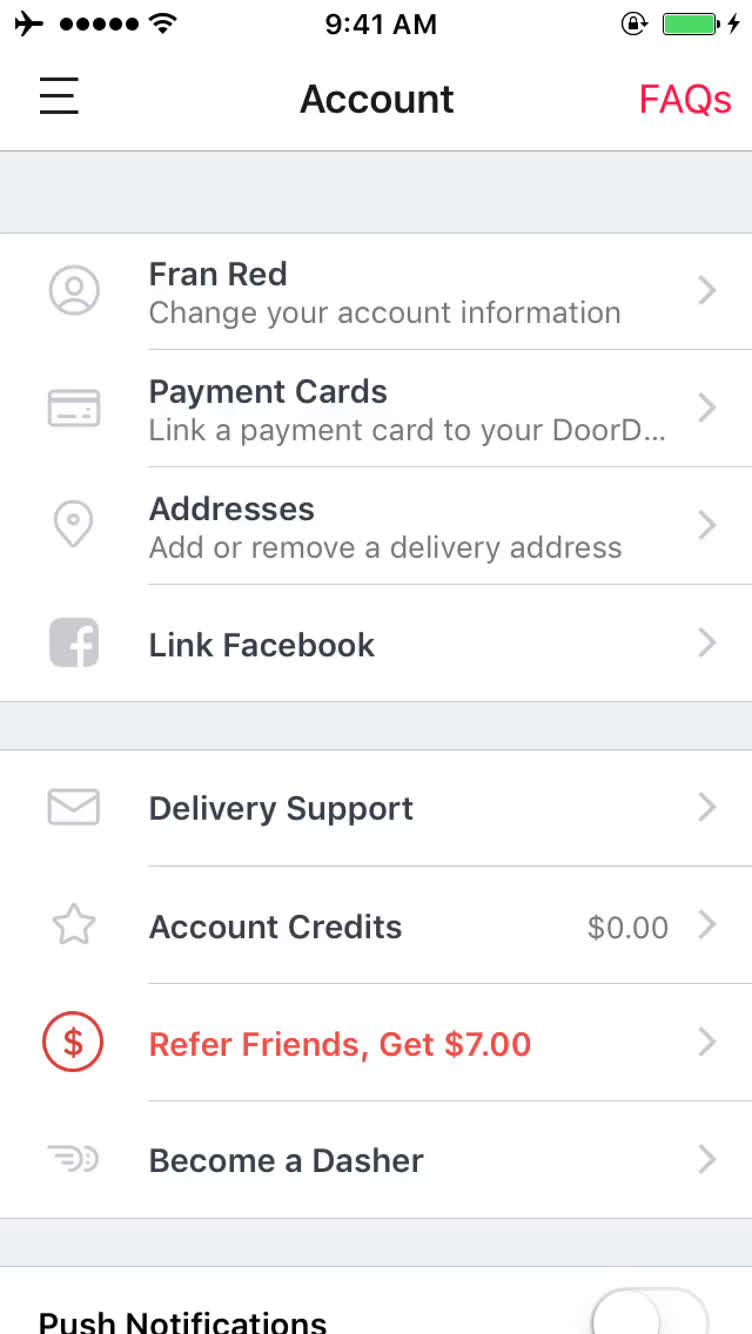

The mortgage member are able to find away about your need amount borrowed, a job records, military solution, and you may social shelter count for a hard credit check. If the money here are a few, you are able to initiate the brand new pre-recognition techniques while having an on-line account from the My personal Veterans Joined portal. It online system enables you to upload, indication documents digitally, and you may display your loan application process.

A pre-recognition try a very in-depth confirmation of the economic and credit suggestions. You will have to upload a government-approved ID, DD 214 having veterans, an announcement regarding solution if you’re towards the energetic obligations, paystubs, 2 years of W-2s, a recently available bank report, or any other records since the questioned. Once you have got their pre-acceptance letter, you’re ready to own domestic browse.

Using Veterans United Realty, Veterans United connects homeowners which have a small grouping payday loans Jansen of experienced and you can educated real estate professionals. These pros comprehend the demands from military homeowners and will assist them score a house that meets Va financing. Virtual assistant financing was to your purchase of primary residencies. You can get to a four-device home with a good Va loan if you plan to call home in one of the equipment. Their possible family shall be who is fit and you may meet the lowest possessions criteria.

Once you have discover your chosen household, you will have to put an offer and possess they around package. The fresh package will include contingencies to withdraw from the pick agreement if the things don’t wade sure-enough in the place of violation out of deal. Using comparables, the agent allows you to settle on a good price considering current market criteria.

After you might be under deal, you will be assigned employment to-do on your own Veterans Joined Portal. The latest opportunities arrive just like the To do. These represent the data files you will have to submit to the loan manager. You have a last evaluation of records because of the an enthusiastic underwriter. A good Va-accepted appraiser will also gauge the property’s market price to make certain one last rate suits positively together with other equivalent features on the field together with assets suits the minimum standards as needed by this new agency.

You’re going to get an ending disclosure form before the finally closing. So it document sumount, loan term, rate of interest, and you will a list of new closing costs. The three-time window provides a borrower time to remark the loan terms and conditions and look for any clarifications until the financing try signed. When the a support representative are unable to sit-in an ending, Pros Joined allows an electronic stamina out of attorneys.

From the Experts United, you could start your pre-certification processes on the internet or keep in touch with a loan affiliate into phone

Which have an excellent Virtual assistant streamline re-finance, you could potentially lower your month-to-month home loan cost. Simultaneously, a Virtual assistant IRRL means smaller documentation as no borrowing underwriting, earnings confirmation, or appraisal are required most of the time. You might be entitled to Virtual assistant IRRRL if the:

Lenders costs an origination commission to pay for management can cost you from the loan. The price tag fundamentally amounts to a single% of one’s amount borrowed.

Останні коментарі