Financial institutions withdraw a huge selection of mortgage loans: the best prices still available for household movers and you will earliest-day people

Loan providers was much slower just starting to set the financial deals back on into sector, but cost are actually greater than before.

Over step one,five-hundred mortgage loans was withdrawn in the last day regarding Sep, resulting in average prices to your one or two-year repairs rising so you can a good fourteen-year high.

Here, i identify as to the reasons banking institutions drawn its income and you can details the lowest priced mortgages nevertheless readily available for house moving services and you may earliest-big date buyers.

That it newsletter brings 100 % free money-relevant blogs, with other facts about And that? Category products. Unsubscribe whenever you want. Your computer data was processed according to the Privacy policy

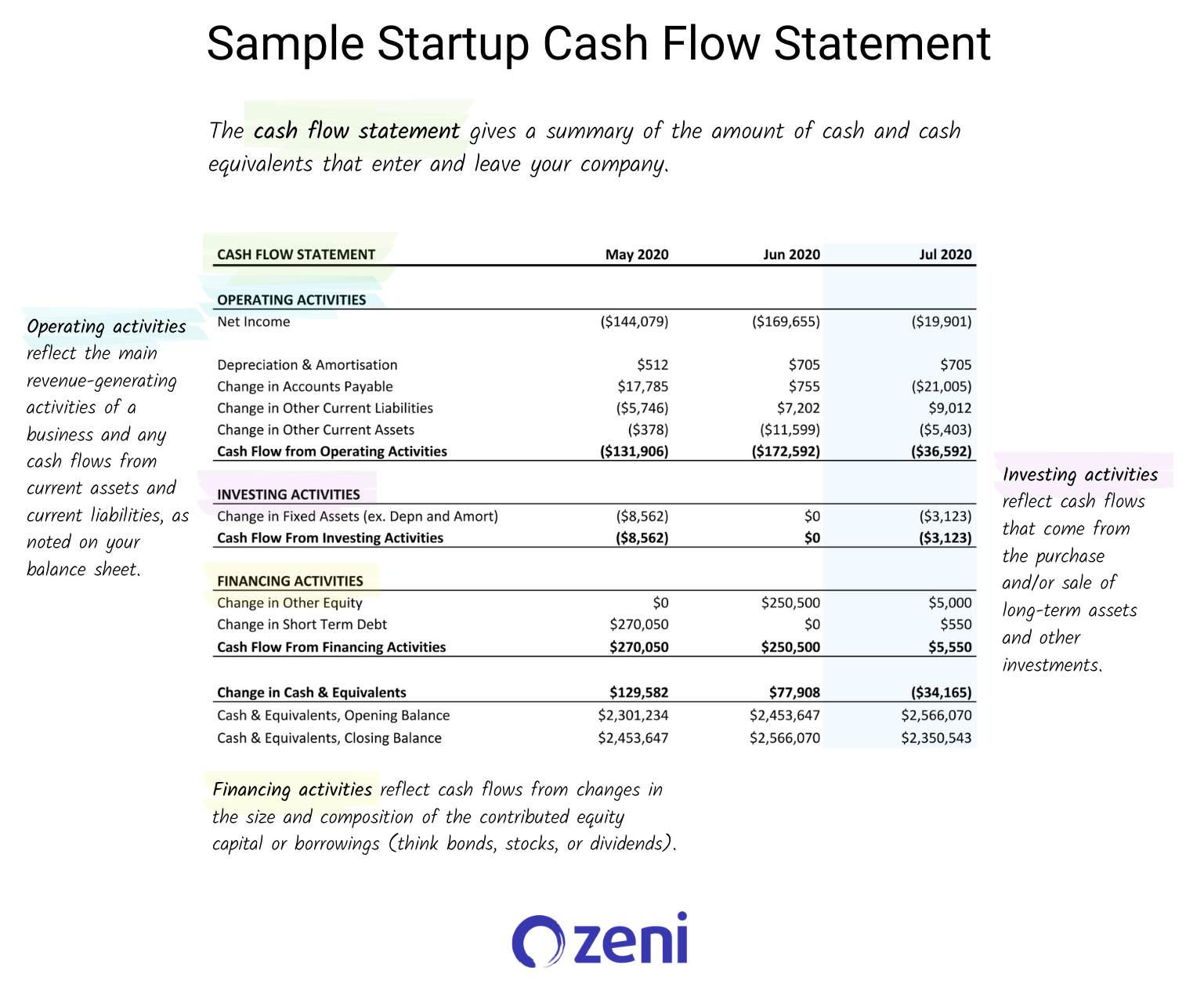

More than, we’ve listed the fresh new deals with the least expensive first rates. This provides an effective sign of the speed you might be able to find, depending on the size of your own deposit, but before going for a deal additionally, you will need certainly to cause for upfront charge.

Some lenders costs fees as much as ?1,999 on their reduced-speed product sales. Of the recharging highest costs, loan providers could offer better cost and you may recover this new shortfall elsewhere.

Finance companies aren’t fees charges instance ?999, ?step 1,499 otherwise ?step one,999, however fool around with percentages instead – like 0.5% of your own total loan amount. Whenever you are borrowing a larger share, this will be alot more expensive.

You’ll always need to pay a made out-of 0.2%-0.5% to obtain a charge-free package. Either, this can pay. Such, if you can score a mortgage at the 5.5% having a ?999 percentage, or 5.6% with no percentage, aforementioned could well be lesser along side fixed label.

While you are not knowing in the which type of deal to choose, a home loan agent will be able to evaluate purchases considering its genuine prices, looking at costs, fees and you can bonuses.

Could you be concerned about your finances?

Answer a few questions and we’ll leave you a personalized record out of qualified advice that will help you take control of your profit.

The length of time if you fix your own mortgage to own?

One of the largest concerns with respect to mortgages are: for how much time in the event that you protect your own rates?

Individuals mostly remedy for sometimes two or 5 years. Five-seasons product sales was immediately following much more costly, however in really period it’s now actually lesser to fix to have extended.

Five-season solutions usually include large very early repayment charges, which means that you could be billed a lot of money for those who ple, for folks who move domestic and don’t transfer they towards new property).

With this in mind, it is critical to consider the typical and you will enough time-term preparations just before buying a predetermined identity.

And that? Money Magazine

Find the best deals, stop cons and you may build your coupons and you will investment with these pro information. ?4.99 thirty days, cancel whenever

What the results are 2nd regarding the financial business?

Property owners on the changeable-price business (instance tracker mortgage loans ) is really confronted by foot price changes, however, men and women arriving at the termination of its repaired terms and conditions was now planning to stumble on a lot higher cost once they remortgage.

Chances are home loan rates will continue to escalation in the brief, which have then legs rate hikes just about to happen.

When your repaired name is originating in order to an-end, its as important as ever before to help you remortgage in advance of becoming managed to move on towards the lender’s simple changeable price cash loans in Wisconsin (SVR). If you lapse to their lender’s SVR, your price will likely rise each time the base speed do.

And therefore? Currency Podcast

Into a current bout of the fresh new And this? Currency Podcast, i chatted about exactly what the shedding worth of the brand new lb and you can rising interest rates suggest to suit your currency – for instance the affect mortgage loans and you will family costs.

Останні коментарі