How to get a traditional Loan while the a primary-Go out Household Customer

Getting a normal mortgage, just be sure to offer a down payment towards property you find attractive. The new down payment matter depends on your financial situation in https://paydayloanalabama.com/cottondale/ addition to particular loan you get.

While you are a downpayment to have a conventional financing can be low as the step 3%, many people opt to set closer to 20% off, that reduces their monthly homeloan payment and you will decreases the amount they must shell out inside desire through the years. Should you choose a changeable-rate home loan, you will need to pay at the very least a good 5% deposit, no matter what mortgage obtain.

Your We

PMI, or private mortgage insurance rates, will become necessary should you want to use a normal financial to help you get your property with less than 20% down. If you decide to default on your loan, individual financial insurance policies protects the financial institution.

The purchase price you have to pay to own PMI will be determined by exactly what brand of mortgage you choose, exacltly what the credit history was, and exactly how the majority of a deposit you devote off. You can typically incorporate PMI into mortgage payment, you can also love to purchase PMI as an element of their closing costs. Consult with your financial expert to choose the most practical way to purchase PMI if it is called for.

After you have 20% collateral of your house, the latest PMI can be removed from your home loan without having to re-finance. In the event the home values rise, you could inquire to have your home appraised to see if you may have attained adequate equity to remove new PMI on your own home.

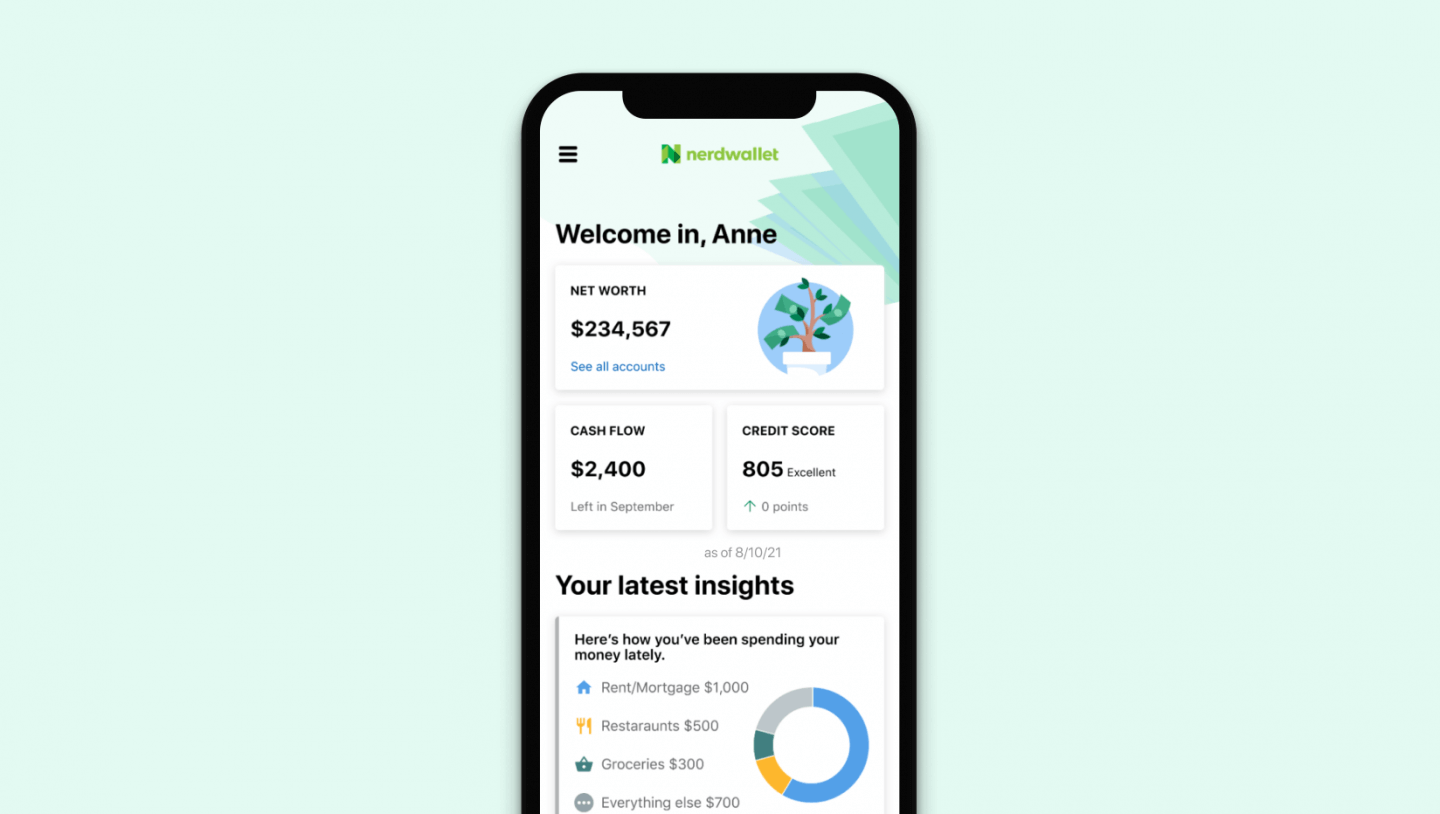

Your credit score

Your credit rating is an essential parts with regards to obtaining a normal home loan. To own old-fashioned financing to possess first-date homebuyers, just be sure to possess a credit score with a minimum of 620. People with high fico scores are usually in a position to be eligible for lower interest levels and a lot more of use financing terminology.

The debt-to-Money Proportion

Your debt-to-income proportion is when far financial obligation you only pay every month as opposed to exactly how much money you have arriving. This provides loan providers a way to know if it is possible to handle the added cost of a mortgage every month. So you’re able to calculate their DTI, you devote right up all minimal monthly payments towards all of the debt and you will separate they by your total revenues monthly. Discover a traditional financial, your own DTI usually must be below fifty%.

How big is Your loan

The size of the loan is essential when trying to find a traditional loan. While this number change a year, the baseline compliant loan maximum going into 2024 is $766,550. Understand that loan restrictions can be highest during the areas where home values try higher than average.

Discover an effective 10-action technique to sign up for a mortgage with Griffin Funding. We work tirelessly so you can describe the method, as we understand that protecting a home loan can feel challenging. The new 10-action techniques so you can get a traditional financing as the a primary-date household consumer is as employs:

- Schedule a breakthrough meeting to talk to a home loan expert within the buy for more information on their home loan options and you will certification. This may occur in people, virtually, or into the cellular phone.

- Might submit an application either during their knowledge appointment otherwise soon afterwards. You could have the mortgage expert assistance you contained in this procedure if you decide Griffin Funding will probably be your lending company.

- Everything you need to carry out to own 3 is actually supply the financing expert consent so you can protect the rate you used to be quoted once you applied for their home loan.

Останні коментарі