HELOC, Household Equity Financing or Unsecured loan

What’s the distinction? When considering financial loans, definitely select the right one for your requirements, lives and you will funds.

When you’re a homeowner trying to find merging financial obligation, doubling down on one to fun renovations endeavor or investing in unforeseen expenses, you’re provided different borrowing solutions for example a home equity credit line (HELOC), a property security mortgage, or a consumer loan. But which one is the best complement your circumstances?

Here is a peek at for each and every option’s secret differences and advantages, plus examples of how they may be studied. That way, you will have better confidence deciding and that choice is effectively for you.

Domestic Collateral Credit line (HELOC)

A home security credit line (HELOC) makes you utilize your own residence’s well worth to fund large costs otherwise unforeseen will set you back. It’s generally a line of credit for how much of your property you probably very own, i.elizabeth., the modern market price minus what you however are obligated to pay. That have an effective HELOC, you might acquire what you need, when you need it, around your borrowing limit. And since the borrowed funds try linked with the value of your own house, HELOC interest rates are usually even more positive compared to those regarding traditional credit lines.

- Freedom HELOCs is actually awesome much easier-similar to borrowing which have a charge card. You could invest as much as their restriction each month, otherwise nothing at all-it is entirely up to you. At the UW Borrowing Partnership, you could protected an informed cost to 5 times from inside the name of one’s line.

- Pay as you go During the mark months, which is the set period of time getting withdrawing funds, you only have to pay appeal on sum of money you use. This provides your a whole lot more versatility over simply how much you have to spend of course you pay they. However, keep in mind that since draw period ends, the loan converts in order to a cost agenda, and you will one another prominent and desire money is owed monthly.

- Taxation experts The same as family collateral fund, desire on the HELOC funds always buy, generate or considerably redesign your residence is actually tax deductible.

Household security credit lines was wise having high projects you to definitely need to be done in stages, big expenditures, otherwise disaster finance, if you are paying off the bill in no less than one three-years. Examples of how somebody explore HELOCs tend to be renovations, consolidating personal debt, college tuition, or paying for medical expense. Mention UW Borrowing from the bank Union’s newest prices, otherwise score a custom rate estimate.

Family Guarantee Loan

The same as good HELOC, a property guarantee loan try shielded by the guarantee, otherwise simply how much of your property you actually very own. Yet not, having property collateral financing, you receive one to lump sum payment which have a fixed rates for terms all the way to fifteen years.

- Low interest Since there are beneficial property support money, interest rates into home equity funds are usually less than most other type of financing.

- Steady The loan’s price, label and you will number are repaired, to help you be confident understanding your payments will continue to be the newest exact same as well as your speed wouldn’t go up.

- Tax-deductible Similar to HELOCs, you could deduct attention towards household security loan fund always buy, generate or significantly upgrade your house.

bad credit personal loans in Alberta VA

Home collateral fund are ideal for large purchases otherwise opportunities you to definitely needs more five years to pay off-particularly if you have collected ample collateral of your property. Samples of other spends are debt consolidation, disaster finance, paying down loans or college tuition. Check out the newest cost, otherwise get a custom made price quotation.

Unsecured loans

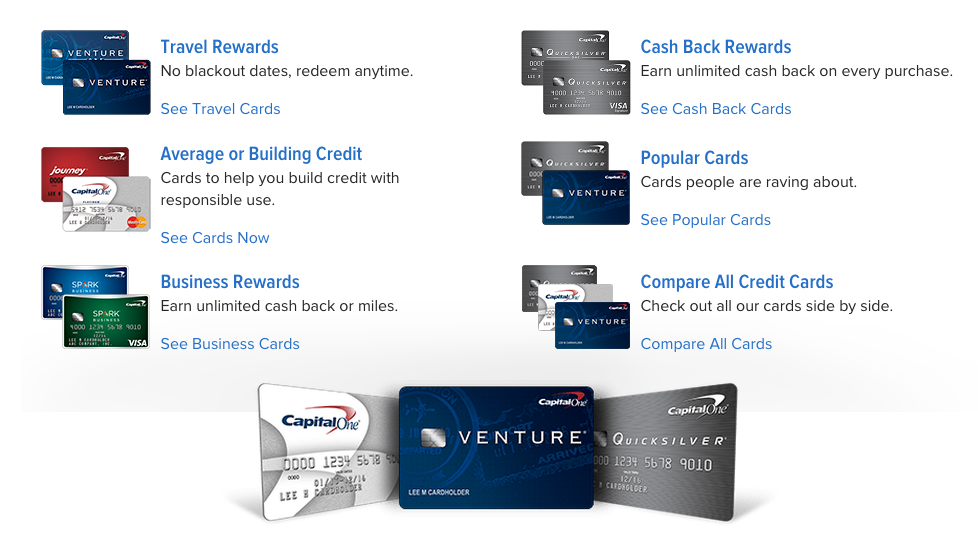

A predetermined-rates personal loan is a great means to fix take control of your bank account. Because it’s a keen unsecured financing, meaning you don’t have to arranged people security to get it, the application and you will approval process is extremely quick. Most of the time, you can acquire a choice rapidly and might access the income a comparable go out. Recognition lies in unique, as well as your credit history, monthly money and debt burden. Rates of interest depend on credit ratings and are usually typically far below that of credit cards.

- Affordable Typically, personal loans has actually rather all the way down interest levels than credit cards, leading them to a choice for those individuals trying to consolidate highest-rates obligations.

- Effortless Just like the speed, identity and you will level of the borrowed funds are common fixed, your instalments will remain an identical and your price would not go right up.

- Short & easy It just takes the ID, a duplicate of most recent paystubs and you will a quick credit take a look at to begin processing a credit card applicatoin. Very apps are canned in one big date, and you can fund are set within this era from signing into mortgage.

Signature loans are superb getting when you have faster so you can typical requests ($step 1,000-$ten,000) planned, are attempting to consolidate higher interest personal debt, otherwise you prefer access to the cash more easily. Investing in moving expenses, relationships will set you back otherwise auto requests are among the almost every other purposes for unsecured loans. Here are some the newest cost here.

However Need help Determining?

Regarding personal resource, there isn’t any single best account folk. Get the friendly, supportive pointers you desire because of the getting in touch with our mortgage officials. They might be willing to help on the financial travel!

Останні коментарі