How to get a mortgage When youlso are Self-operating

You have struggled to create a corporate. Whatever the stage of your own process you are in correct today, you are aware it’s taken loads of persistence. You might be confident regarding the investment additionally the income you have. Today, you are prepared purchasing property. Yet, to invest in a house because a home-working individual are hardly very easy to perform. Traditional loan providers want multiple methods to get complete prior to they approve a borrower for a home loan. But not, at UMe, i have a lender Declaration Financing Program in regards to our notice-functioning players to make providing home financing smoother!

Do you want to try to get that loan?

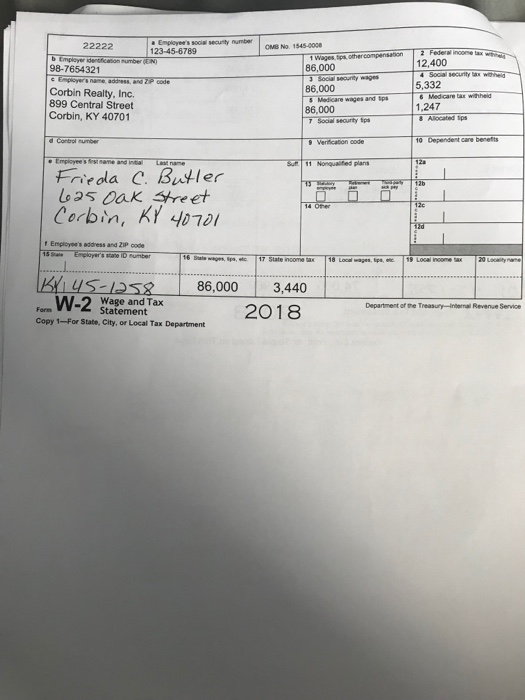

For those who are mind-working, having less a W-dos can seem to be debilitating. Lenders consider work as a result of a family because an even more steady function cash, even although you keeps years of sense dealing with your money since the a https://paydayloanalabama.com/smiths-station/ personal-working private.

Contemplate, this is the job of any bank to make sure you feel the cash to essentially build your financing costs. And, they want to make sure you will tend to be in a position to store performing one to throughout the life of your property. This may generate care about-employed financing a little more difficult.

Gather Any Files

When you need to submit an application for a home loan given that a good self-working personal, there are many actions you can take now that could possibly offer you peace of mind which help that reveal lenders you are well-competent to borrow money. Every financial regardless of the sorts of earnings you’ve got will have to be certain that your revenue. Documentation assists the lender to ensure you have the capacity to repay your financial situation.

For someone having a manager, getting suggestions throughout the earlier in the day half a year in order to a-year are preferred. For those who are self-functioning, it is important to look back sometime then.

- 12-two years out-of Organization Financial Statements otherwise Individual Bank Comments

- A listing of your entire obligations (listed on your credit score)

- Proof of self-employment (organization permit or firm in the an excellent reputation)

- Low Mortgage-To-Value (LTV). The loan split up by your value translates to your own LTV. 80,one hundred thousand divided from the one hundred,000 = 80% LTV. Lenders goes to ninety% but some thing less than 70% is most beneficial.

- A good credit score Rating. (640+)

- 5+ Age operating due to the fact thinking-employed.

- Supplies away from step three+ Days. (What number of months you can pay the month-to-month obligations that have the liquids loans you really have readily available). Minimum is 3 months supplies but more 12 months would be best.

Show The Well worth

You will need to prove you’ve got the credit history, demonstrating you create wise behavior. You will find several trick steps you can take to simply help make certain you get access to the borrowed funds you want.

Continue Organization and personal Earnings Independent Good starting point is splitting up your earnings and expenses from your team earnings and you will expenses. It appears easy sufficient to perform, especially if you work a small business. However, doing this can make it more complicated for the financial observe exactly what your correct expenses is actually. Whenever you can, have fun with a special account to manage your organization costs, including the brand new gadgets you buy otherwise the latest list. Don’t use yours bank card to take action.

Replace your Credit history A low credit score causes it to be more complicated so you can be eligible for an alternative mortgage. When you may not have getting the greatest get, typically loan providers will require significantly more careful run a home-operating person’s borrowing from the bank.

- Pay down the money you owe.

- Prevent playing with credit around you have been.

Останні коментарі