The applying is actually financed owing to $400,one hundred thousand in the city’s standard loans and off good $fifty,000 donation away from First Vista Lender

Show that it:

Daily, our very own news media dismantles barriers and you may shines a white to the crucial overlooked and you can below-reported factors crucial that you every Northern Carolinians.

Before going …

If you need what you are training and trust independent, nonprofit, nonpartisan journalism such ours-journalism how it will likely be-delight sign up to remain all of us going. Reporting similar to this isn’t absolve to produce therefore do not manage this alone. Thank-you!

The town Council voted unanimously Saturday for officials check out broadening its existing Good neighbor Homebuyer Mortgage System to provide most of the qualified town employees.

Since January, the readily available study, the typical sales price for a current unmarried-house into the Fayetteville are $189,450, predicated on Longleaf Oak Real estate professionals.

Some Zero codes into the Fayetteville, eg 28314, 28306 and you may 28304, watched develops dealing with 20%. Zero codes 28305 and 28312 – and therefore one another watched a growth of around 31% – provides average product sales charges for existing single-household members residential property at the $243,100000 and $304,504, respectively.

There were a critical adore of housing will set you back, Gran Mitch Colvin said at the Monday’s City Council meeting, suggesting to the recommendations improve.

Property try aggressive … rather than it are that bring or a couple of also provides, it is 10 has the benefit of. So you’re able to extremely place them regarding the games, they must place an elevated deposit into the ways prices have left right up.

Fayetteville’s monetary and you may community development manager, Chris Cauley, told you in the an interview until the appointment your program incentivizes positive neighborhood facets in 2 trick indicates.

Immediately after which it is reasonably on the save – turning the tide away from rental so you can homeownership. That’s one of many demands having having difficulties neighborhoods. Another person’s granny dies, in addition to grandchildren have several other condition, and additionally they only lease our home aside until they can not rent our home any more. That’s just how enough communities decline over the years.

It is in the city’s desire together with community’s total to help you help give self-confident property control and homeownership of a beneficial generational riches viewpoint, regarding a residential area coverage perspective and just off conservation out of assets tax viewpoints in those communities, staying those neighborhoods unchanged.

Should your Town Council approves an available intend to build the latest system throughout the future months, eligible city professionals can put on into guidelines as soon as April, Cauley said.

Who is qualified?

Personnel must have struggled to obtain the metropolis for at least an effective seasons and you may received an excellent meets criterion within their latest research.

They have to be also a primary-big date homebuyer, that area considers once the anyone who is purchasing the property, often inhabit our home since a first house and has now had no possession, best or mutual, within the home regarding three years before the time from purchase.

Into the Fayetteville, that is $58,100 to possess a single person, and it’s really $65,700, $73,eight hundred and $81,a hundred, correspondingly, to possess house brands away from one or two, about three and you can four individuals.

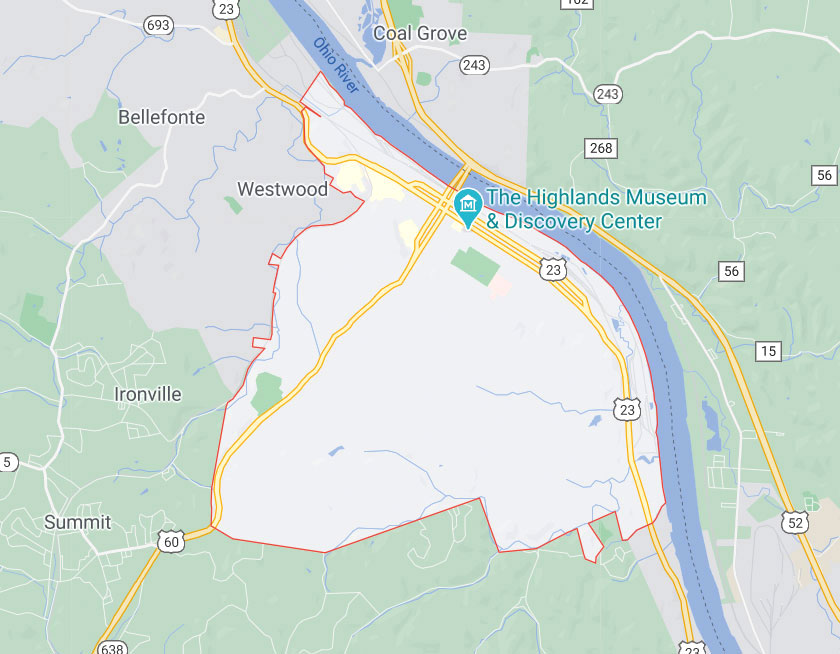

As it already is obtainable, the application form is restricted to property on Central Campbellton community therefore the Murchinson Roadway Passageway.

The metropolis Council including chosen having authorities look into increasing you to definitely in order to four other areas – Massey Slope Area, Bonnie Doone, 71st Section Society and Deep Creek.

Each of them revolve doing low-earnings census tract parts, elements that in some applications i telephone call difficult to establish, Cauley said.

In the event that we have been extremely looking to attempt to would homeownership and you will suggestion the scale within our redevelopment parts, off tenants so you’re able to homeowners, upcoming this can be a rather great program to get it done.

How system performs

This means the amount owed, in the case your area personnel chooses to offer, usually disappear because of the 20% annually more a good four-seasons several months.

After the 5 years, the borrowed funds, that is given on zero per cent debt consolidation loans, will be thought paid in full.

As this is said to be a good forgivable mortgage by the Irs, group may also have to blow taxation towards recommendations given that it might be noticed element of their yearly settlement.

Homebuyer studies category

While the system were only available in late 2019, Cauley said in the a half dozen cops keeps inquired about the application, but none have bought a house because of it.

Cauley mentioned that the main reason centered on feedback try you to definitely officials failed to getting they certainly were willing to buy a home.

Sign up for discovered the totally free weekday development bulletin as well as in-breadth, investigative news content regarding personal attention issues in the New york.

Its mothers might have been renters its whole life, and purchasing a property is actually a serious situation. And it is challenging. We wished to build a first-day homebuyer knowledge category because an element of which.

Cauley said the town carry out discover a certified casing counselor which create show the potential people how to navigate the latest homebuying processes out of interested in a lender and you can real estate agent to finding a home within their price range.

There is a lot one to goes in to acquire property, going regarding renting to purchasing, Jones said. The fresh kinds was going to getting beneficial since it prepares them getting things that they could n’t have to begin with regarded as otherwise got to manage for the leasing top.

Why not other people around?

During Monday’s appointment, council associate Shakeyla Ingram inquired about incorporating most other employment beyond your city payroll on the program, particularly teachers and you will firefighters.

The fresh legalities of these are different than simply all of us money our very own individual employees, Cauley said. That it fundamentally will get the bottom of their payment.

That is not to say that i couldn’t, however, who does need certainly to sometimes be a unique council recommendations for all of us commit manage something like that.

Останні коментарі