Other choices to possess Investing in Do it yourself Plans

When you find yourself an inferior installment months could possibly get indicate large monthly obligations, it is going to suggest faster attention paid off over the name off the mortgage.

Imagine if you use $fifty,100000 within 6% notice. For individuals who choose for a good five-seasons payment title, your own monthly installments would be $967 thirty days (not including costs), therefore create spend almost $8,one hundred thousand for the interest. In the event that loan was paid in full, might keeps paid back your lender on $58,100000 to use $fifty,one hundred thousand.

Financing of the same amount and you will interest, however with a longer label, have a under control payment per month, but be more expensive in the long run. By using seven years to settle an identical $fifty,100000 at the six% desire, you’ll provides an inferior payment around $730, nevertheless total focus number paid off could be larger, at over $eleven,one hundred thousand That cashadvancecompass.com personal loans near me $fifty,000 will end up costing almost $62,000.

Simply how much Are you willing to Obtain?

Exactly how much investment you are going to located having an individual home improvement financing is based on multiple facts, including:

If you learn your income or credit history is actually carrying you right back, you can also imagine making an application for a personal bank loan with an excellent cosigner . This plan could help you become approved if you cannot considering their creditworthiness.

Shopping for money to possess house fix otherwise remodeling doesn’t usually come down to home improvement loan against. consumer loan. There are more choices which you can use to pay for do it yourself will cost you.

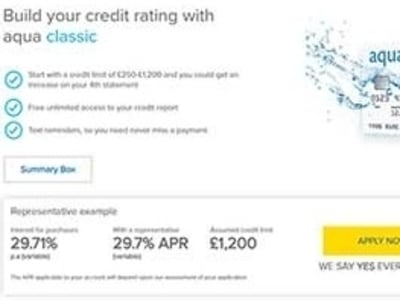

Low- or no-attract charge card: Some individuals could possibly get opt to fool around with a credit card that gives a minimal – or even 0% – introductory Annual percentage rate. Normally, a powerful credit score and you may credit score are needed to be considered for it marketing offer, which could last between18 and you may 2 years.

Domestic guarantee financing: If you have security of your home, you will be capable borrow against a share from it, normally up to 85% of any security you accumulated. Such as for example, when you yourself have $a hundred,one hundred thousand within the security, you could potentially obtain to $85,000. The loan continues is actually marketed in a single lump sum payment. Financing fees words are very different with each bank, but it’s you’ll be able to to track down an installment title all the way to 3 decades.

Home equity personal line of credit (HELOC): A good revolving credit line, an effective HELOC is yet another brand of financing which allows you to definitely borrow against your property security. Area of the difference between a great HELOC and you may property equity loan is how the mortgage proceeds is delivered. Rather than the debtor finding a lump sum payment, the funds out of an effective HELOC is going to be lent because they’re called for and you can paid off – as much as the credit restriction – into the mark months, which can last up to throughout the a decade. In the event the mark period closes, the brand new cost period initiate, which is up to three decades. Loan terms and conditions usually, definitely, will vary by lender.

FHA Label step 1 Loan: Insured from the Government Homes Management, an enthusiastic FHA financing will likely be awarded by the any acknowledged bank or lender. The only real catch that have an enthusiastic FHA Identity step 1 loan is that the upgrade should be permanent and it cannot be to have a great deluxe goods. It indicates it won’t safeguards the purchase and installation of an effective pool otherwise day spa, nonetheless it will assist which have things such as adding an extra restroom or fixing your house’s electric system.

Applying for a fixed Rate Personal bank loan for Do-it-yourself

A home try a financial investment and, like all opportunities, it entails specific attention to make it work well for you. Keeping your house who is fit could possibly get involve solutions or other developments over the years, nevertheless costs for the things pays of inside the an effective family that is attending hold or increase its really worth. Financing the individuals will cost you that have a house upgrade unsecured loan might permit that make the most of this long-label funding.

Останні коментарі